Over the last year we have mentioned several times how important it is to change your routine and be more intentional about your spending.

Eliminating your spending, or cutting back is a GREAT thing – that trip to Starbucks or Target may have you spending less, and put you in a beter direction financially. Even more, it can motivate you to do more – cut back in other areas, make more changes, or even revamp your budget to allow you to open up an even greater window of opportunity for you to dig yourself out of debt, payments or even get ahead.

But changing your routine is just a single step – and while it might help you spend less, it certainly won’t do much more unless you act on that …

Just over 9 years ago when I was working in Phoenix daily, I used to start my day at Lifetime Fitness, then drive north past Jamba Juice, before getting on the freeway to go into Phoenix.

That $2 – $3 a day was a pretty huge chunk of change, I realized it was a waste of my money and it’s not that I truly enjoyed the visit.. if nothing it was just a routine I had fallen into.

So I gave it up.

I found myself with an extra $15 (more or less) a week.. $60 a month. Did it make a huge difference in my budget? Not really honestly.

That $60 could have found it’s way to lunch with coworkers (but I did bring my own).. or, I could have used it on the vending machines at work. I guess I could have gotten something at the store on the way home with it too.

But then that would have made it pointless to stop visiting Jamba Juice, right? I mean, if I’m going to spend $3 – $4 a day, then stop that routine, ut spend that money on other things that are just simply not necessary, I’m still not really any better off.

Cutting your spending is not enough – you really DO have to do something productive with that amount.

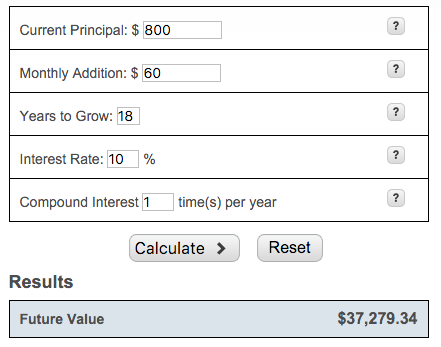

What I ended up doing… and it worked out rather well. It was the same year I had my first (Wendy), and she’s now 9.. for all of our kids, I opened up a college fund when they were born – that FIRST month we put in $800 in each of their accounts. I had opened one up for Wendy when she was first born and so I threw that $60 in her college fund as our monthly contribution.

I set up an automatic transfer from my checking account – $60 a month… coming out on the 1st, because I would not forget about that day.

How can anyone forget about the first of the month? You just can’t.

Keeping that automatic transfer going, it has now been almost TEN years since that commitment. At an average of 10% rate of return, compounded over time, she is projected to have $37,000 when she graduates.

Isn’t it risky? I’m not sure how to answer that, except to say that not investing anything is even more risky. You’re only going to lose it if you pull it all out when the market takes a dive – otherwise, leaving it in there really isn’t harming you. Market down? Then your money is working harder for you.

Where can you get 10%? You can’t get those returns. Well, you can – but not in a bank account. I think we mentioned we opened up a college fund. Yes, that means our money is working for us in an investment. Remember we said average return, not guaranteed. If you wish to use a savings account as your vehicle, then that’s fine, just understand that while you will get 1.5-2% (if not less) your institution will rake in the average of 10% and keep the difference. After all, they are in it to make money too.

Use this as a motivator to start an Emergency Fund. OR, a Roth IRA … perhaps pay down some debt. But understand that a few things are required:

- You must take action – that means stop spending. It’s the only way you can free up extra money. Be willing to sacrifice somewhere.

- You must then follow through – if you take that money and put it towards something financially productive, great things will happen.

Stay committed. It’s just too easy to avoid doing it altogether, so just skip the easy route – which involves doing nothing. Just don’t kick yourself later for not taking the chance to save while you had time on your side.

Do something – move forward. Take action to turn some of your personal choices into a positive financial action.