In most cases, people associate investing {LONG term} with LOTS of dollars.

The whole concept of putting away long term is scary…

How do you start? How much DO you invest? What “rules” are there (if any) — and while all of those areas are important to define before ou start, equally as important is actually getting started.

I would probably venture to say that once the hurdle has been jumped .. it’s all relatively easy after that.. Just a few months ago, I ran across an app that HELPS you do that.. I am having fun with this app.. and so far I have been really surprised at the simplicity of it.

I’m hoping that perhaps some of you give it a try, and see if it works for you as well as it works for us.

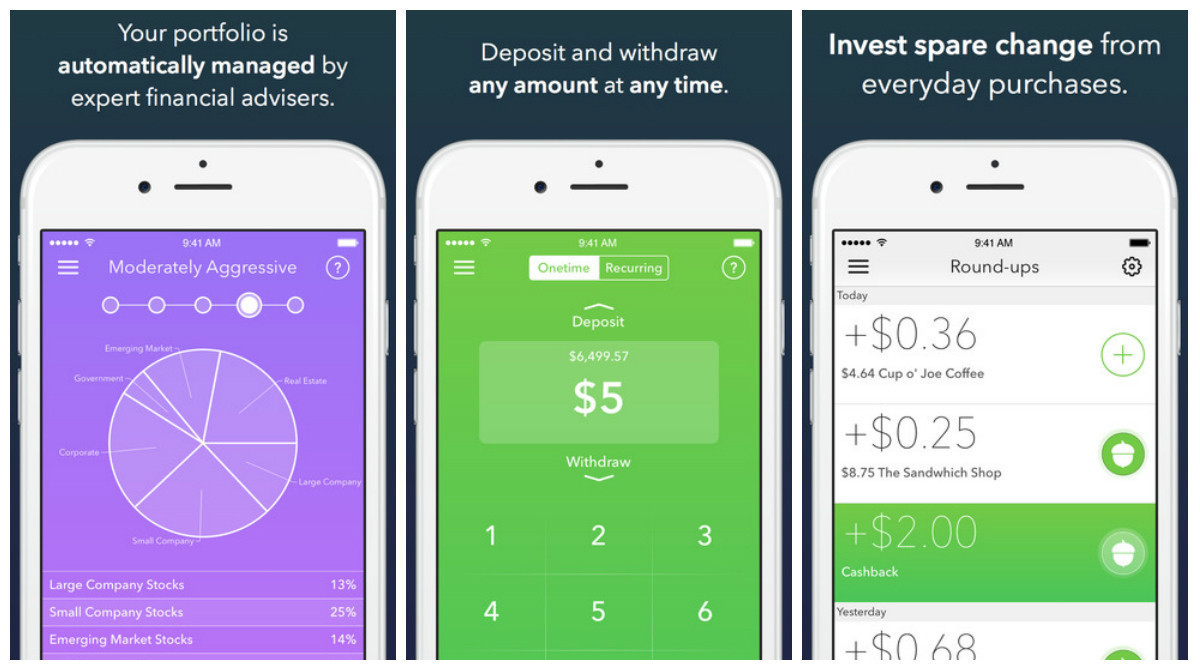

Acorn is an app that will help you invest your space change into low cost investment funds. And while I know there are banks out there (specifically Bank of America) with programs similar {such as “Keep the Change”…} Acorns is different – because you are not limited to keeping that change in a bank account but a vehicle that’ll work harder for you.

Register, then connect your checking accounts (and debit cards) — Acorn will automatically round up every purchase to the next dollar. It will then INVEST the difference in a portfolio of YOUR choice.

As an example, if you spend $3.25 at Fry’s .. it will take $.75 an invest that difference for you.

You can ALSO invest lump sums too — up to $30,000.

The best part about Acorn is that you get to select the FUND of your choice. Since I have over 20 years until I hit my retirement (projected…) I have mine working in a high risk fund – but that’s because I can withstand some risk right now.

Acorns takes the intimidation out of investing… it helps you be deliberate with your money without sacrificing TOO much. You might think that you will miss that extra change, but in reality, you won’t.. and it adds up very quickly.

Acorns is hoping that by making the amount small enough, it will inspire people to start investing earlier. If you want to be more proactive, you can chose to invest larger sums from your checking account or even set up automatic deposits on a regular basis.

(…I am a HUGE proponent of paying for things in cash – but I do have a considerable number of items that are paid automatically through my Bank Account. For me, however, this is just ANOTHER way I can tuck away a little money. I haven’t made it my only vehicle ~ and won’t.. but it certainly does work well to have as an additional avenue. For some people, that extra “swipe” can lead to MORE spending, but

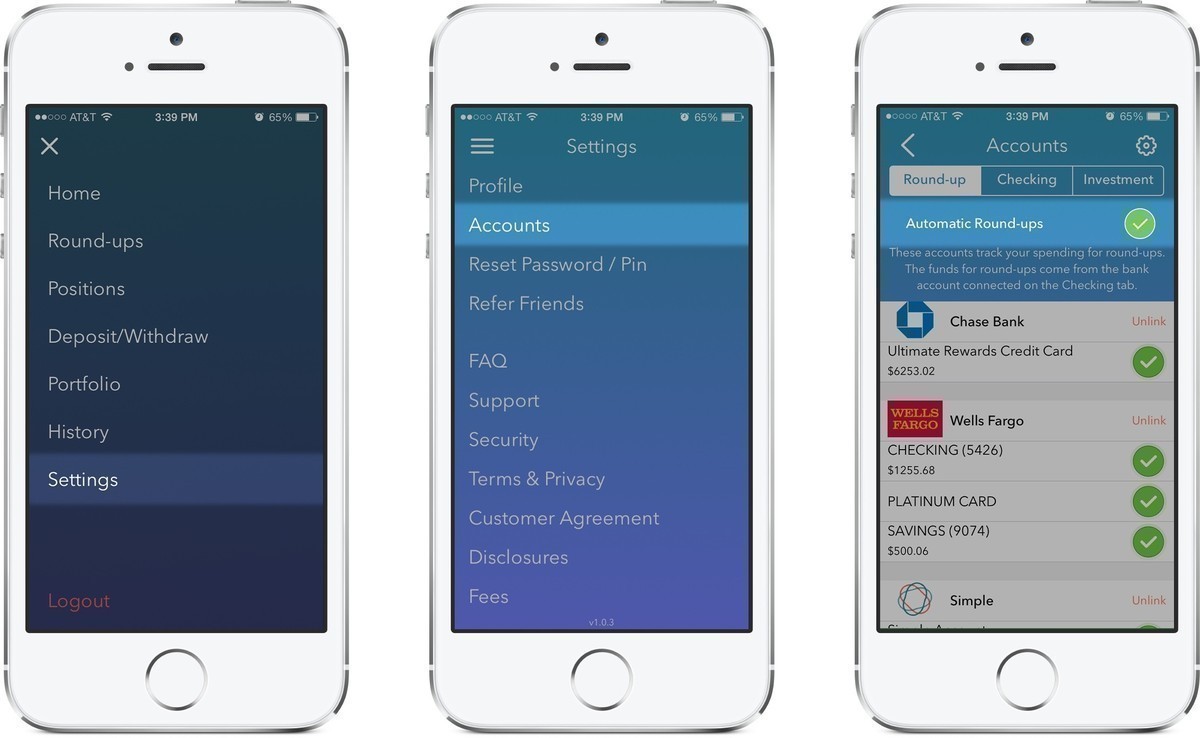

After inputting your basic information .. you will answer a few questions about your time horizon .. and risk tolerance (for example.. I’m in my mid 30’s and have just around 20 years left to make my money work for me…). The app will then recommend a fund for you ~ but.. you do not have to stay in that fund. You can choose to invest with another… if you wish to be more conservative (if you have a shorter horizon of time) or…if you wish to put your money in a higher risk fund.

If your balance is less than $5,000, then the app costs $1 a month; once you hit $5,000, the cost 0.25% to 0.5% of your investment {annually} – you can actually estimate how much you’ll pay in fees on the site.

But… although it IS a fuss-free, convenient way to put away, I would not rely on it as your only investment vehicle ~ when you use Acorns I would encourage you to stick with it for the LONG term (after all, that’s what investing is about – right?) I would also have a regular investment (IRA or Traditional) that you contribute to regularly.

Leave a Reply

You must be logged in to post a comment.