Saving for a college fund can be daunting! Here are 5 steps to help you move forward to and start a college fund for your children.

Chances are if you have kids, you have, at some point, thought about the cost of their future career plans. College is not cheap – the average cost for one year of college right now is just under $9,000.

If your children have plans to attend at a school out of state, or a larger university that number may essentially be more.

When your high school student talks about college, it will likely involve money. Chances are, most students will borrow to attend, racking up (in some cases) up to $50,000 if not more in student loan debt.

Funding College

As a parent… one of the best things you can do is to encourage them to make the decision that is best for them. For almost ten years I worked with high school juniors and seniors approaching college to help them map out their career options. It was quite surprising what you heard when you sat down to talk with them.

Many had no concept of financial aid – what it is, how it works, and the fact that you essentially need to pay it back. To receive federal grants, you have to apply for aid. When you apply for aid, those grants that you may possibly qualify for, are indeed combined with the aid money issued to you. They pay your school each quarter and issue you the rest in the form of a check.

Most kids get excited for the “excess disbursement”, cash it, spend it, buy things with it. But in the end, it’s loaned money.

Money you are obligated to pay.

Don’t want loans? Unfortunately seeking grants means taking out loans – and the process begins.

After having completed one Master’s and starting a second, I know full well that student loans are something most people end up carrying for years.

Years.

In fact, I have friends in their 40’s and 50’s that are still paying off loans.

Thankfully we served in the military and were able to pay for our undergrad work through the GI Bill and enlistment bonus offers. Our graduate programs, however, were different. That was a rather large expense that took us several years to pay off.

Close to 75% of the students I worked with did not know what they wanted to do in college. They just knew it was “somewhere they should go”.

Have a Plan in Place

While college is great, it’s even better when you have a plan in place.

Many of the juniors and seniors we worked with had very little to no discussion with their parents about any type of savings vehicle to help pay for their choice. In fact, some of the parents just mentioned “that’s what scholarships and loans are for – right?”

That alarmed me…

Not long after when I started having my own children, I was adamant about starting a college fund for each of them. A little preparation and sacrifice on my b behalf is well worth a better plan for them later on.

After all, the last thing I wanted was to start my children off at the age of 18 with the mindset that loaning money is required.

It’s definitely not.

Saving now is far cheaper than borrowing later.

A recent study by Sallie Mae shows that 36% of middle income families and 29% of low income families are actually putting away for their kids college fund. Are you one?

When referencing a college fund and looking at parents, people usually fall in 1 of 3 categories:

- Parents who have established a savings vehicle. They contribute regularly to that vehicle for one or more of their kids with intent to pay for their child’s college/higher education

- Parents who have no savings vehicle. Perhaps they can’t put away or, they feel that it makes their children less apt to appreciate the effort it took to save

- Parents who have established the need for a vehicle and intend to help their children put away. They won’t fully fund, but they will assist their kids in saving something to help them later on.

With that in mind, sometimes starting a college fund can be daunting. Many people don’t know where to start. They may assume that they can’t afford to put away. Others might just need that gentle push to get started.

5 Steps to Saving for a College Fund

Here are 5 tips to help you help you start that college fund for your child.

Find a Savings Vehicle

Find the right vehicle – a savings account at the bank is great. Long term, it’s not what you want for a college savings.

A 529 plan is a vehicle that allows you to put money in that is designated for college. There are many out there, some each with different fees and operating costs. We started ours when each child was born with one lump sum and a monthly contribution that comes out in the form of a draft.

529 plans have many advantages – one being that the earnings aren’t subject to federal tax. Unlike other vehicles, lifetime contributions may range from $200K to $400K – depending on your state. You’ll want to speak with an investment advisor – in some cases your bank can point you in the right direction.

Save Small Amounts each Week

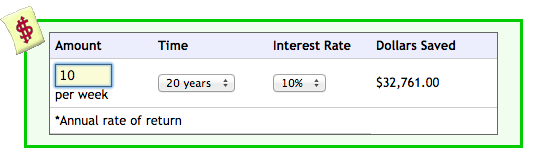

Saving $10 each week can add up to a significant savings. Analyze your weekly purchases. How many times do you drop into Starbucks and spend $5? That $20 meal at the Drive Through could easily have been a college fund addition. Can’t find money in your budget? Look at changing your withholdings, instead of getting back a huge refund at tax time, it’s better to adjust… take some of that money and put it to work through the year.

They key is saving small amounts over long periods of time.

Read our 14 Tips to Save MORE to find additional ways to help you save…

Avoid Money Leaks

Money leaks are those items you spend on each week that you may not realize – that $5 Starbucks coffee, mMocha or breakfast item. It could even be stopping in at Sonic, lunch at work, etc. You don’t have to cut back completely but cut back enough to free up money that you could be throwing in a fund for college.

Set up a Draft

Take the time to set up an account for each child, and a draft from your checking that will automatically pull out a set amount each month. It will force you to budget for that gap and it might just be easier than you think. One of the hardest steps to putting away for your kids is actually making the initial move to put away.

In most cases, once you budget for that amount, you will forget about the draft. A few years later, you will thank yourself for making that initial step.

Cut your expenses in obvious places

Find ways to save that are right in front of you… chances are you do have the money to put away, it’s being used in the wrong areas.

- Cut the cord on your cable and move to more cost effective options.

- Take a look at your cell phone bill and downgrade to a different plan (or bundle for a better price).

- Try making your own laundry detergent.

- Avoid shopping in stores that create temptation for you to spend (Target)

- Be consistent with meal planning

- Shop with cash, and leave the cards at home

Taking the initial step to put away is undoubtedly the hardest step for most. Understanding that small amounts can add up huge over time will help motivate you to start putting away for your kids.

Every effort you can make now to help prepare them later will be worth sacrificing for. Having the option to attend school with the option of using scholarships and a college fund will help better prepare them later in life.

I have considered a 529 plan for my son but am concerned because there is a pretty stiff penalty if the money is not used for college. Right now I only have him so there is no other child that could potentially use that money if he does not go.

Understandable. Though 529 plans can be passed to a spouse, yourself, grandchild, nephew, niece, opportunities are endless. Best to save regardless, and if he opts not to, he can still use it for a trade school. If he opts not to go to even a trade school, it won’t go to waste. It’s more of a risk not to put away.