It’s a common question asked, how do you build up your credit report?

The answer will be different depending on who you ask.

It’s very common today to ask that question and get the response you are looking for – ie. the only way to build credit is to have credit, take out credit and pay back that credit regularly.

But I’m on the other side of the grass when it comes to this subject – with a clean credit report and money in the bank, you can honestly do anything you want to do.

It’s true – you can’t really argue with that at all.

What is your Credit Report?

Your Credit Report is nothing more than a list obligations – public filings, loans and how you have handled those loans. In terms of your credit report, there really isn’t anything to “build up”… people with money may have very little on their report, but they have money in the bank.

Credit Report versus Credit Score

When people talk about building something “up”, normally they are referring to their credit score. That score is nothing more than a calculation of riskiness for a lender providing you a loan. The only reason to use a credit score is to acquire more debt – debt that you likely don’t need in the first place.

In the financial services industry, it’s touted that you NEED a high credit score to be successful and live the life you want. Without it, you can’t get ahead. Disagree? I do.

We are a credit driven society – so a credit score seems like a must. But the problem is that in order to get a high credit score, you have to go into debt and stay IN debt for a period of time.

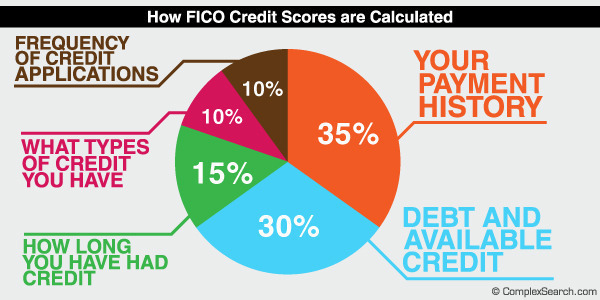

Looking at how your credit score is calculated, almost every component is related to debt.

Not once do they take a look at what you have in the bank – do they?

The only way to have a lengthy history is to and pay your debt consistently over time. Unfortunately there are no brownie points for paying off “all” of your debit and staying OUT of debt (like we have done..) — I am a testament to the fact that my credit score is penalized because I no longer pursue debt obligations.

We paid off everything and as a result, our scores are low – do we care? I’ll be honest, we just don’t care. We manage our lives by paying for our purchases in cash and using our debit card and we have no plans on taking out any loans in the foreseeable future. We don’t do car payments, and we have always been able to pay for our vehicles with cash. But then we don’t drive brand new cars/trucks either ;)

Both my husband and I have a government security clearance – we haven’t had any issues maintaining it without a “high” credit score. In fact, they don’t even look at the score but our report ~

The credit report obtained by investigators does not include an individual’s credit score, so it matters not that your score might be 720 or above (considered a good risk by companies offering credit). The investigators and adjudicators are looking at various factors: your total credit liability as it compares to your income; payment history; liens, garnishments, and judgments; bad debts and collection accounts; any history of bankruptcy; and how this information compares with information you entered on your electronic Questionnaire for Investigation Processing (eQIP).

Here are some of the myths that surround Credit:

#1 – You need credit to be successful.

False – you need credit to get more debt… being successful has nothing ton do with credit. You can be successful without credit – I consider ourselves successful and we don’t have credit so this myth is far from correct.

#2 – Credit cards can be beneficial if you use them responsibly.

This couldn’t be farther from the truth – credit cards were never set up to be advantageous to you – they were set up to benefit the credit card industry. They know the rewards system will be too tempting for people to say no to, and all it takes is ONE emergency to happen (ie. job loss, medical circumstance, etc) to miss ONE payment, to spiral into a bad situation.

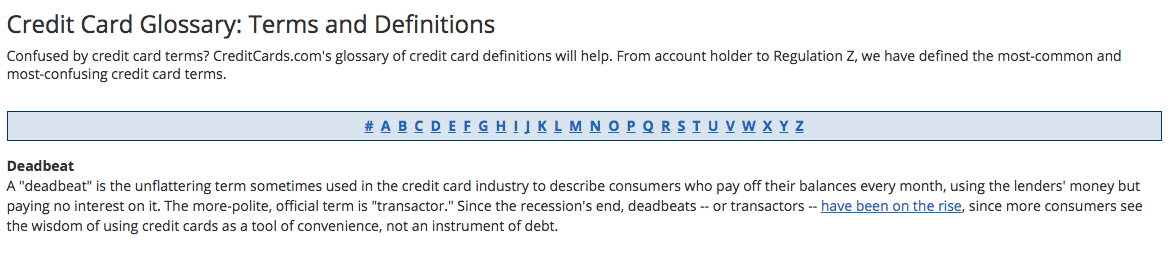

Credit Cards were set up to get and keep you in debt. Only credit card companies would consider someone a deadbeat who pays their balance in full, and on time, each month. Don’t you think that’s twisted?

#3 – You can’t build your credit score without credit.

…. Truly wealthy people don’t rely on credit – they use cash, and live within their means. And by truly wealthy we are not referring to the people who financed fancy cars that are driving around town – we are talking about the people who use cash, and live within their means.

The only reason to build up your credit score is to USE credit – to get yourself into more debt.

#4 – I need to build my credit score to get a job, rent a car, and get an apartment.

This is also false – potential employers look at your credit report. They do NOT look at your credit score.

An employment background check often includes a copy of your credit report. The three major credit reporting agencies (Experian, TransUnion, and Equifax) provide a modified version of the credit report called an “employment report.” An “employment report” includes information about your credit payment history and other credit habits from which current or potential employers might draw conclusions about you.

An employment report provides everything a standard credit report would provide. However it doesn’t include your credit score or date of birth. Nor does it place an “inquiry” on your credit file that may be seen by a company looking to issue you credit. Having too many credit inquiries tends to lower your credit score. —Source

Many people will have employers that need to see your credit report – it’s important to remember that your credit report is different than your score. It’s important to explain to your employer why you don’t have a credit score … and yes, it is possible to live without a credit score entirely. Having a pile of debt is more of an inconvenience.

In renting an apartment, most apartments will be willing to work with you if you provide a deposit (first, last month’s rent) – it’s important to let them know you prefer not to go into debt and to use cash. Apartments will look at your credit report to see if you have delinquent water/power bills, evictions as well.

We should be working to create a clean credit report – not freaking out by opening accounts and taking on more “credit” to establish a score. Right?

#5 – You need credit to rent a car.

This is again wrong – because have no credit and we have rented cars without ANY issues – from Hertz, Budget AND Enterprise – and all within the last 3 years.

MOST car rental agencies accept debit cards. You might have to jump through more hoops using debit – but you CAN use debit instead of credit. Sure, they will place a bigger hold on your account, but if you budget your money, then that shouldn’t be an issue.

Debit is no more unsafe than credit when traveling – of course, credit is a higher risk as you are using money that is not yours. But when you make a purchase with your debit card, YOU have the option to run it as a debit or credit. If you use credit, you are protected by the card company’s zero liability policy – and you are NOT responsible for unauthorized transactions.

Nobody can beat the credit card companies. According to Credit Card Debt Statistics, the the average household has $9,600 in credit card debt. And the average U.S. adult carries $5,540 on any given credit card.

Personal finance is 80% behavior – you need to cut out those habits that make you spend more. Building wealth does NOT happen with credit cards – you are playing a billion dollar industry.. nobody is smart enough to “win” their game.

Leave a Reply

You must be logged in to post a comment.