In a savings rut? Here are 3 ways to jumpstart your retirement so you can make the most of your investments and establish a savings goal for the future.

I admit: I geek out when it comes to saving money. I’m also just as much of a geek when it comes to planning for retirement. What can I say? I love the challenge of saving.

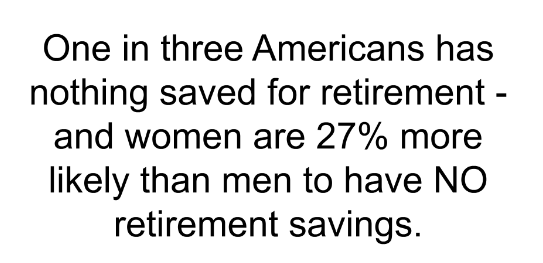

Every year we see some pretty staggering numbers in regards to saving money and retirement. Just today I read an article about Americans and their retirement which was alarming to say the least.

One in three Americans has nothing saved for retirement – and women are 27% more likely than men to have NO retirement savings. (Src)

Of those who have saved some money for retirement, we have saved $25,000 or less between savings and investments.

Why is that though?

I think the most common reason is that Americans are living in the now. Many are living with day to day expenses, and they just can’t see giving up any extra money for something that seems so far away. For many, having a new car might be more important than saving for retirement. After all, retirement is 30-40 years away. Who wants to plan that far out?

Most younger people think “I’ll deal with it later.. right now is not a good time.”

But instead, right now is a better time to set up a process and let that money work and compound for you through that next 30-40 years. You should look for between 70-80% income replacement during retirement. And although social security may be an option, it will only replace about 40% (or, even less for some of us with 20-30 years left to go).

To make sure you are maximizing your retirement savings, you should be putting away 15-20% of your paychecks. And for those of you who are stay at home moms, it’s just as important for you to put away too. Your options (pension plan at work or pension match at work) may not be as easily available. So it’s up to you to take the time to sit with an investment professional to set a route so you can have the same opportunities.

The good news between all of this is that you can make a few changes to your budget this year. Kick start your retirement without costing you much at all.

You Need to Have a Budget

In order to know where you are going, you have to know where you are at this point in time. By creating a budget you will determine where your money is going. Give each of your dollars a place mark, and direct your money to the appropriate place so it’s unlikely to be wasted on nonessentials.

First, add up all of your income – then, your expenses. Subtract your expenses from your income until you have a balance of zero. That budget will help you set amounts for food, your house payment, fuel, college savings and emergency fund. It’ll even allow you to budget for your retirement.

Be proactive and set aside 15-20% of your income in a 401K (+ match), or Roth IRA. If you make $50,000 per year, that’s $625 per month!

Considering a majority of Americans aren’t saving for retirement, and many who are probably aren’t doing $625 per month – how possible is it to save $625 each month?

Here are 3 ways to Jumpstart your Retirement:

#1: Cut your Entertainment Spending: Look for alternative ways to enjoy time with the family. Instead of going to the movies (which can easily be $30 – $50 if not more), look for cheaper entertainment options. Try concerts in the park, or invest in a projector and do family nights at home. Americans spend as much as $229 per month on Entertainment. By cutting that in half or more, you have an extra $100 – $120 to sock away.

#2: Adjust your Witholdings. You don’t want a tax refund. It could be working for you much better than it is working for them – in 2015, the IRS reported the average refund as $2,800. It’s now 2018 and that amount could very well be even more.

If you adjust your withholdings, that’s $233 per month back in your retirement account each month.

In terms of withholdings, many people may assume they’d rather be “safe than sorry” – meaning they’d rather overpay than underpay. While that has some truth.. that is why it’s important to have a tax professional assess your finances on a quarterly basis.

Your finances should be a monthly review, not something you adjust yearly. Sit down on a monthly basis and re-analyze. Then you won’t have to wonder if you are over or underpaying. If you are self employed, it IS possible to adjust your withholdings to allow that money to work harder for you – I’m self employed …. and I know that overpaying can be avoided. But as we mentioned, it requires monthly review and communication between you and your tax professional.

Your finances are not and shouldn’t be on a “set it and forget it” schedule.

Not only is a refund of $2,800 instant money to jump start, it also means you can adjust your withholdings from that point forward. So not only are you getting back the equivalent of $233 per month, you will also want to change your withholdings. Allow that $233 per month to go back to you from that point forward. Be diligent enough to sit down with an investment professional to put that in a savings vehicle to work for you.

#3: Stop Eating Out (or, Cut Back): The Average American household spends almost half of their food budget eating out. Of $6,000 per year, about $2,700 goes to eating out. Alcoholic beverages account for $500 of that. More than 75% of Americans eat out once a week. Some families eat out as much as once every two or three days. (Src)

$2,700 per year is $225 per month. Combined with the amounts you freed up from your tax refund, withholdings, and a cut in entertainment spending, that’s over $600 to jump start your retirement. That’s just for one year.

After those Steps

You aren’t done yet! If you score a bonus or raise at work, take the initiative to divert that entire bonus to your retirement or savings to avoid spending it. It’s money you haven’t quite adjusted to earning yet, so re-routing it won’t make it “missed” too much.

I know it’s hard when there are so many other ways to spend it . The temptation of new clothes, new floors, home upgrades, or even a vacation can be fierce. I’m not saying you can’t do those things, but instead of using that bonus for that, use it to jumpstart your retirement. You will thank yourself later.

- Learn how to avoid making a car payment (which can eat up your income!)

- Learn to live with less – including cable and internet

- Pick up a second job on nights or weekends for extra opportunities to save, or get rid of things you don’t need in the form of a garage sale.

Once you kick start your retirement, read these tips for investing long term to make the most of your investments.