Many people today have some type of money problem – perhaps they are not content with the amount of money they are spending. They could very well be living paycheck to paycheck – unable to get ahead.

Despite pay raises at work, or cost of living increases, they can’t seem to establish any type of a substantial savings.

It’s a struggle to pay the credit card bill each month – for years, you tell yourself that perhaps your situation is the result of entry level pay. You will do better when you get paid more .. and at that point, you’ll be able to make headway.

The years roll on, and you still can’t make a substantial dent in your savings. Your credit card bill is still coming in the mail regularly and you are in the same predicament that you were several years early – this time it’s different. You can’t blame that entry level pay.

As the years pass on, you would like to be financially generous to help those who can’t help themselves, but you find yourself so paycheck to paycheck that you can’t even help yourself, nevermind anyone else.

A solution seems rather impossible… unless you can truly embrace the art of buying less.

Can it really help?

Buying less can be one of the best decisions you will ever make in your life – buying the things that are needed, and paring down the things you own can be liberating. You’ll find yourself with more money available – more time, and energy to spend time doing the things you truly love.

Buying less means cleaning less, organizing less, and fixing less. It forces you to re-evaluate your values. Rather than chasing after all those ‘perceived’ good deals, invest your time and energy into things that make your life much more worthwhile.

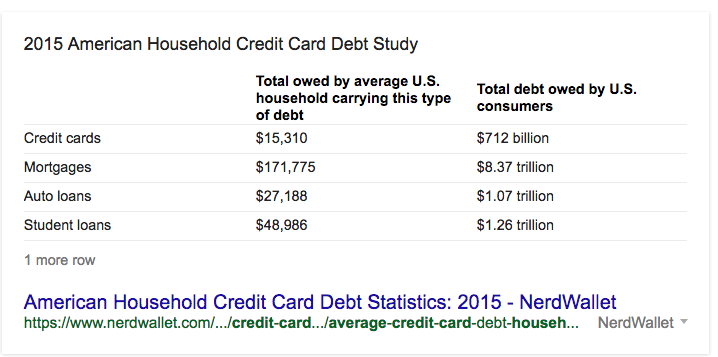

But is buying less the simple solution to the huge financial mess pictured above?

The answer is yes – although it might not appear to be the single solution, it plays a huge role.

Have debt? The average household carries $15,000 in credit card debt. While longer work hours can help you repay the debt, buying less will also allow you to repay that debt over time.

You’ll need to be persistent. You will also need to have patience – and don’t forget discipline, because it’s not an overnight solution.

Your credit card debt is the result of your purchase habits, so since buying too much is the cause of your issue, then buying less can help you alleviate the problem of incurring more.

How buying less might help you fall back in love with your job. Many people are discontent in their job – they dread going to work each day, and some feel trapped in a job that offers limited opportunities for advancement. Some might feel trapped because they are in need of the health care offered by the position. But others are trapped truly because their lifestyle has them in that predicament. From a car payment or two, to a mortgage payment, student loans and credit card bills, they haven’t accepted living on less. The decision to live on less will help you find a job you love instead of a job you feel like you must remain at simply to pay for the lifestyle you have chosen to live in.

How buying less can help relieve your fear of future retirement. Retirement statistics are everywhere – and the consensus is relatively the same no matter what you read. Many Americans are not saving for retirement because they are too busy trying to get ahead – ahead of their bills, waiting for the right time to start, waiting until they pay off their debt. The key to saving for retirement is starting early and investing regularly. But if you are stretched paycheck to paycheck how does one do that? Buying less will allow you to save more – whether savings, or retirement account. Your account will only grow with regular contributions.

How buying less can help with your current income. Most money problems people encounter are the result of a lack of money. Our perception is that more money (ie. larger income) would fix those – we could pay off bills, save for retirement, and even enjoy life – right?) After all, more money would allow us to do things that would make us happy – or at least that’s the perception. Unfortunately, if you can’t find contentment in your life with the money you currently make, than more money isn’t going to help with that contentment. Learning how to live with less and buy less is a great place to start. ;)

How buying less may improve your marriage. One of the biggest reasons for divorce in the U.S. is financial stress. That stress can be the result of spending indifferences, loss of income, or prior financial issues that were brought into the relationship. Although buying less may not repair a broken marriage, it won’t hurt to give it a shot. Perhaps buying less will open up other avenues of your marriage to help you agree on things easier.

Does buying less solve every area of your current financial situation? Probably not. But at least it will help you find some awareness towards a few areas of your life that money [or lack of] can dictate.

If anything, it will help give you a different perspective.

Leave a Reply

You must be logged in to post a comment.