We’re in the middle of 2016 – can you believe the year has FLOWN by?

If your finances are your priority this year (and they are always mine!) then you will want some help with better focus on where your money is going.

Even better, if you are with an iPhone or Android app you can use any of several FREE apps available to help you learn where your money is going, get alerts for bills, and see how much money you have left (to save, or even apply towards debt repayment!)

Here are some of the BEST {FREE} budget apps to help you do that ~ these apps can ALL help you save, avoid fees, and put you on a better path to building a savings or emergency fund, and potentially even help you find money to set aside for retirement. Some apps do have a pro version with a cost, but the basic concept of the apps is FREE for all.

Remember though: All the apps in the world can work wonders, but the BEST way to find out where your money is going is to use pencil and paper and create your own budget every month. Once you find out what your expenses are, on paper, then anything leftover should be prioritized – cash goes into envelopes and money set aside. Working with cash is one of the best ways to prevent yourself from overspending.

Mint App

Mint is a very popular {FREE} app that makes your budget easy – connect your bank, and the app will help you create a budget based on your spending.

Mint is available for iPhone and Android – so you can see your budget on your phone, as well as your desktop – you can even set up and manage your bills to pay on time. They will send you alerts to odd charges and give you tips on spending.

They do have email support, though it leaves a lot to be desired if you have an issue.

PocketGuard

PocketGuard is a step UP from Mint — if you haven’t yet tried Mint, you might just want to try PocketGuard first. PocketGuard connects to your account so you always have current transactions & balance.

You can see what’s in your account, how much you have spent, recurring payment, and a very simple outline of where you are spending – including the ability to breakdown each area to show you what you are spending and how you can spend LESS.

You can find PocketGuard for iPhone, and Android.

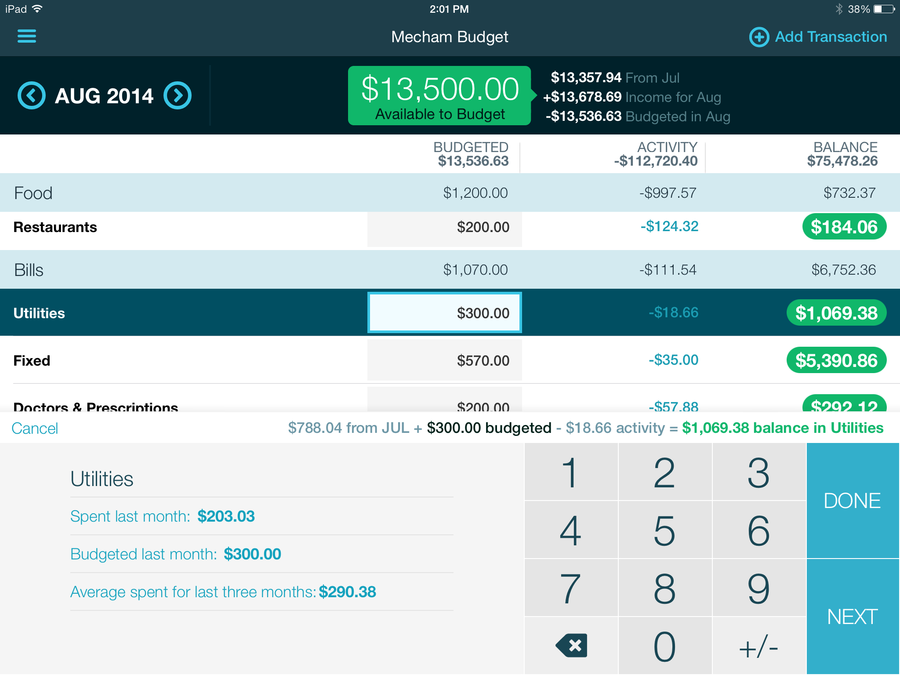

You Need a Budget (YNAB)

This is one of my favorite apps ~ although it’s free for the 1st 34 days, it’s $50 a year after that (or, $5 per month). YNAB helps you link all of your accounts, and bills into one screen to show you what your current balances are .. your expenses, categories, and your monthly bills. You can add a transaction, and you can create your budget from your stats.

They also offer classes to help you learn more about the app and how to get started.

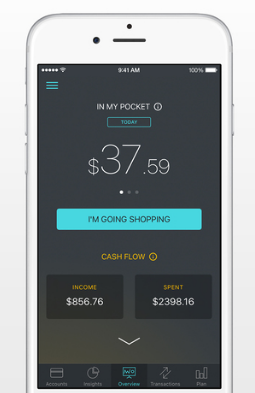

Level Money

Level Money is another app that will help you streamline your finances – after you pinpoint your accounts, it will detect your income and expenses and give you an idea of what you can spend. This app, like others, connects to your bank accounts, and is free for iPhone and Android.

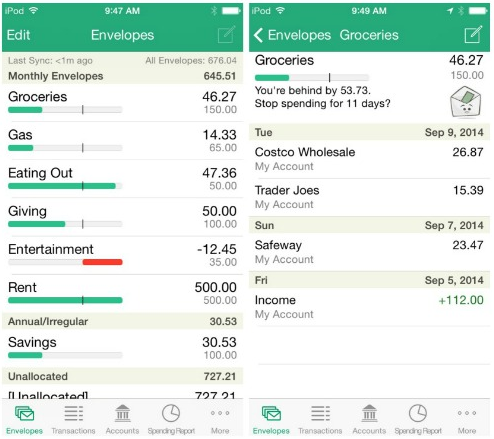

GoodBudget

GoodBudget is a FREE app for iPhone and Android – though you can upgrade for $24 (6 months) as a pro subscription for more leeway in accounts, devices, and even envelopes.

This app allows you to sync your budget across devices, and uses a digital envelope method – so much like cash envelopes except in digital format so you don’t have to carry around concerns about having cash in your pocket.

EveryDollar

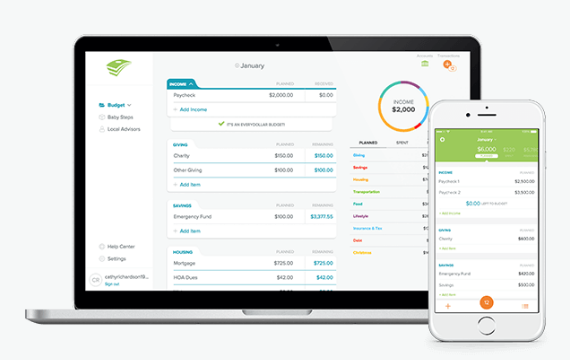

EveryDollar is a NEW budget-based app created by Dave Ramsey’s Company and released on March 23rd 2015.

It will allow you to create your first budget in JUST 10 minutes – once you set up your account, you can set up your budget in a clean and easy to understand way. Everything is very easily categorized — from Pet Care to Clothing, School Tuition, and (more items that are already set up). EveryDollar is visually appealing and overall very easy to use.

While the basic version of EveryDollar is FREE, the pro version is $99 per year and comes with an option for a real (live) phone call and email support.

In the end, there are many additional apps out there, as low as FREE in cost – finding the one that appeals to you the most will be something you will have to go through. While we use EveryDollar (and we DO pay for the $99 per year version), not everyone may agree with the cost of paying for an app to help you budget – especially when you are trying to get out of debt.

Almost every budget app has somewhat similar features – but what differentiates them is the ability to enter your own transactions (or, have them imported), functionality and visuals.